Forbes: Four Trends Leading Safe Asset Investment, turning risks into opportunities

|

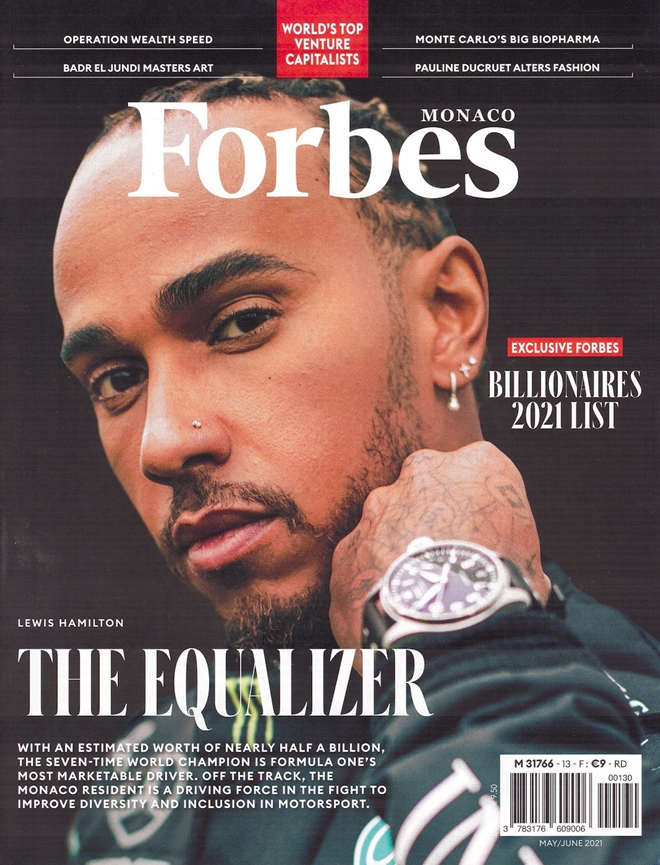

| The article on investment trends and opportunities of SAPA Thale Chairman was published in June issue in 2021 of Forbes magazine. |

Accordingly, a number of trends currently emerges from the pandemic, says Mai Vu Minh. It is beginning with investments in safer assets such as gold and U.S. or Japanese bonds. Merger & Acquisition (M&A) is also expected to experience a sharp increase due to comprehensive restructuring, a result also of the COVID-19 impact, as is digital transformation as company’s cost-cut and downsize. Another striking opportunity lies within the change of supply chain and value chain.

An obvious lesson drawn from the COVID-19 pandemic is a greater attention to healthcare from governments and businesses, particularly disease prevention and environmental protection. This is good news as any country soon considering it a national policy will have better resistance along with more possibilities for sustainable and harmonious development.

As for the financial service sector, according to the Chairman of SAPA Thale Group, in spite of negative impacts such as low credit growth, increased bad debt and reduced profitability, the pandemic still brings many positive impacts. Specifically, it accelerates a non-cash payment trend and fosters fintech and bigtech for penetration into the financial market, creating competitive pressure for the banking industry to accelerate the digitization process. The next positive element lies in fundamental changes in customer behavior leading to new demands for products and services. “This provides financial institutions with opportunities of reviewing and developing their products for better service and customer experience,” says Vu Minh.

|

There are at least four important groups of investment opportunities that can be identified in the near future, including in digital businesses, public investments, healthcare and movement of capital flow.

For digital investments, according to Vu Minh, many organizations and businesses have been operating and trading on automation platforms, digital finance development, digital banking, fintech, e-commerce, for example, aimed at maintaining production and business activities to overcome epidemic difficulties along with the current trend of Industrial Revolution 4.0. As a result, there will be more rapid growth opportunities for support services such as logistics, fast shipping, packaging, platforms, event livestreams and cybersecurity.

Billionaire Mai Vu Minh comments that opportunities will also arise from an increasing trend in public investment, especially investment in social security, infrastructure, renewable energy, and ICT infrastructure and health services. These investments are of interest by countries because they both promote growth and create a premise for long-term development. Beneficiaries of this trend include sponsors, involving businesses, financial institutions, consulting organizations and localities.

For healthcare, there is a wider expansion of investment and business opportunities in manufacturing medical equipment, medical services, healthcare, pharmaceuticals, green products, and environmentally-friendly products.

On ongoing trend, the movement of investment capital flows still continues as the transition usually takes place over one to three years, with the company’s continued diversification of supply chains and the government’s encouragement and support actions.